Some Known Questions About What Is Trade Credit Insurance.

What Is Trade Credit Insurance Fundamentals Explained

Table of ContentsTop Guidelines Of What Is Trade Credit Insurance10 Easy Facts About What Is Trade Credit Insurance DescribedSome Ideas on What Is Trade Credit Insurance You Need To KnowSome Known Questions About What Is Trade Credit Insurance.The Single Strategy To Use For What Is Trade Credit Insurance

ECI, the cost of which is typically integrated into the asking price by exporters, need to be an aggressive purchase, because merchants ought to get insurance coverage before a customer comes to be an issue. ECI policies are used by numerous exclusive industrial risk insurance provider as well as the Export-Import Financial Institution of the United States (EXIM), the federal government company that aids in financing the export of united state

For a lot more on credit score insurance coverage, visit the EXIM internet site.

Some Ideas on What Is Trade Credit Insurance You Should Know

Profession Credit score Insurance coverage provides accessibility to information held by insurance firms about the economic health and wellness of firms you are planning to do organization with. Insurance providers can share this details with their insurance policy holders. Your consumers have a vested rate of interest in guaranteeing their providers can get trade credit score insurance as well as provide details of their approximately date trading activity to the insurance companies.

If you are considering utilizing billing money, profession credit scores insurance coverage can supply your finance business with the security they require to provide added funding. Using Trade Credit Insurance coverage to supply customers and potential customers a lot more good credit history repayment terms and also restrictions. This can have a tangible effect on your sales performance.

While we have no recognized connection to Julie Andrews, right here at The Network Collaboration our company believe in being familiar with our consumer. Over all, please do not assume we merely 'supply' profession credit scores insurance coverage. Our service surpasses that even if you choose not to deal with us at the end of the day.

What Does What Is Trade Credit Insurance Do?

Or, if we believe that credit report insurance coverage isn't special info suitable for your organization, after that we'll be truthful and put in the time to discuss why we think this is as well as information alternate options we believe it's the appropriate thing to do. We value our individuals who are the backbone to what we do, as well as this is reflected in the solution that we offer to our customers.

For many companies, the worth of the debtor's journal, the cash you are owed, is just one of the largest properties as well as yet it is often not guaranteed. Most services guarantee various other essential properties without hesitation, yet the danger to a business of client insolvency can be one of one of the most unpredictable direct exposures.

Unless you demand repayment ahead of time or are covered by credit report insurance, this makes you prone to uncollectable loan (What is trade credit insurance). Ask on your own, what would certainly be the impact of one of your biggest customers go to these guys stopping working to pay you? Any type of organization selling products and also solutions on credit scores terms with direct exposures to uncollectable loans ought to strongly take into consideration profession credit scores insurance coverage as component of their organization risk strategy.

Trade Credit score Insurance policy is greatly used in the Building and Construction industry as well as utilized by services of all dimensions with minimal yearly turn over normally beginning around $750,000 upwards. There is no 'one size fits all' technique when it involves Profession Credit Insurance and the level and also price of your plan will certainly be determined by your requirements.

Little Known Facts About What Is Trade Credit Insurance.

For two years business has been damaged. We have a broad option of products assured to insure your organization against the unpredicted; find out which one functions for you.

Our main focus is to be the leading Profession Credit score, Insurance coverage along with Surety & Bonds options service provider, by sustaining our clients' growing demand throughout, Africa. Get an insightful, inside view profession credit report insurance with our most current news and also updates.

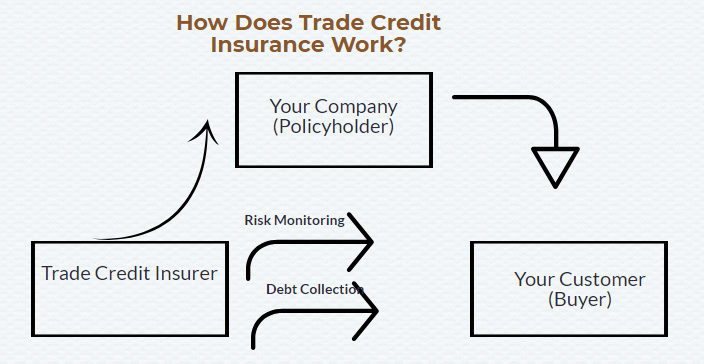

Trade debt insurance coverage is a method of shielding your receivables (invoices) from non settlement. It is a significantly preferred kind of protection against customers which either refuse to, or can not, pay their debts. What is trade credit insurance. Let's learn exactly how it works Component Trade credit score insurance policy, sometimes called 'uncollectable bill protection', is an insurance cover for businesses against consumers that do not pay their financial obligations.

It can be utilized as a standalone product covering the entire company receivable; as a screw on for billing financing; or to cover a particular portion of a firm's billings, for instance those from exports only. Trade credit rating insurance is currently a prominent field with different remedies customized to different segments of the marketplace.

What Is Trade Credit Insurance for Dummies

Underwriters use what are called actuarial strategies (statistical analysis of danger in insurance) to take a look at the market of trade, the credit rating of the companies involved, previous poor debt experience as well as a variety of other factors. Based upon this analysis, the expert will certainly establish a credit official site line for each company to which the credit insurance coverage will use.

In some circumstances this may not cover the overall quantity of the profession yet a percentage only. Along with its standard protection, credit score insurance has the added value of supplying understanding into the credit-worthiness of your customers (What is trade credit insurance). This may enable you to make smarter calculated choices as you expand the business.